salt tax repeal june 2021

Proposed Amendment to Manufacturing Sales Tax Rule. It would have left the 10000 cap in.

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Democrats consider SALT relief for state and local tax deductions.

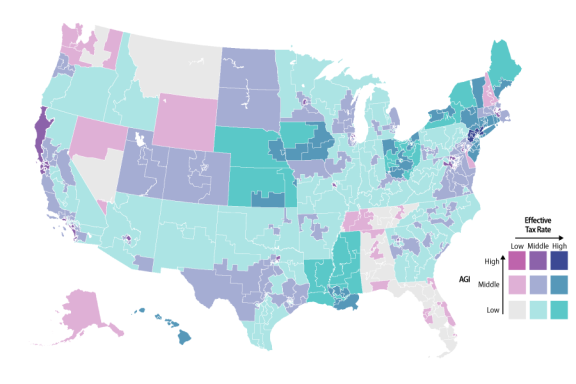

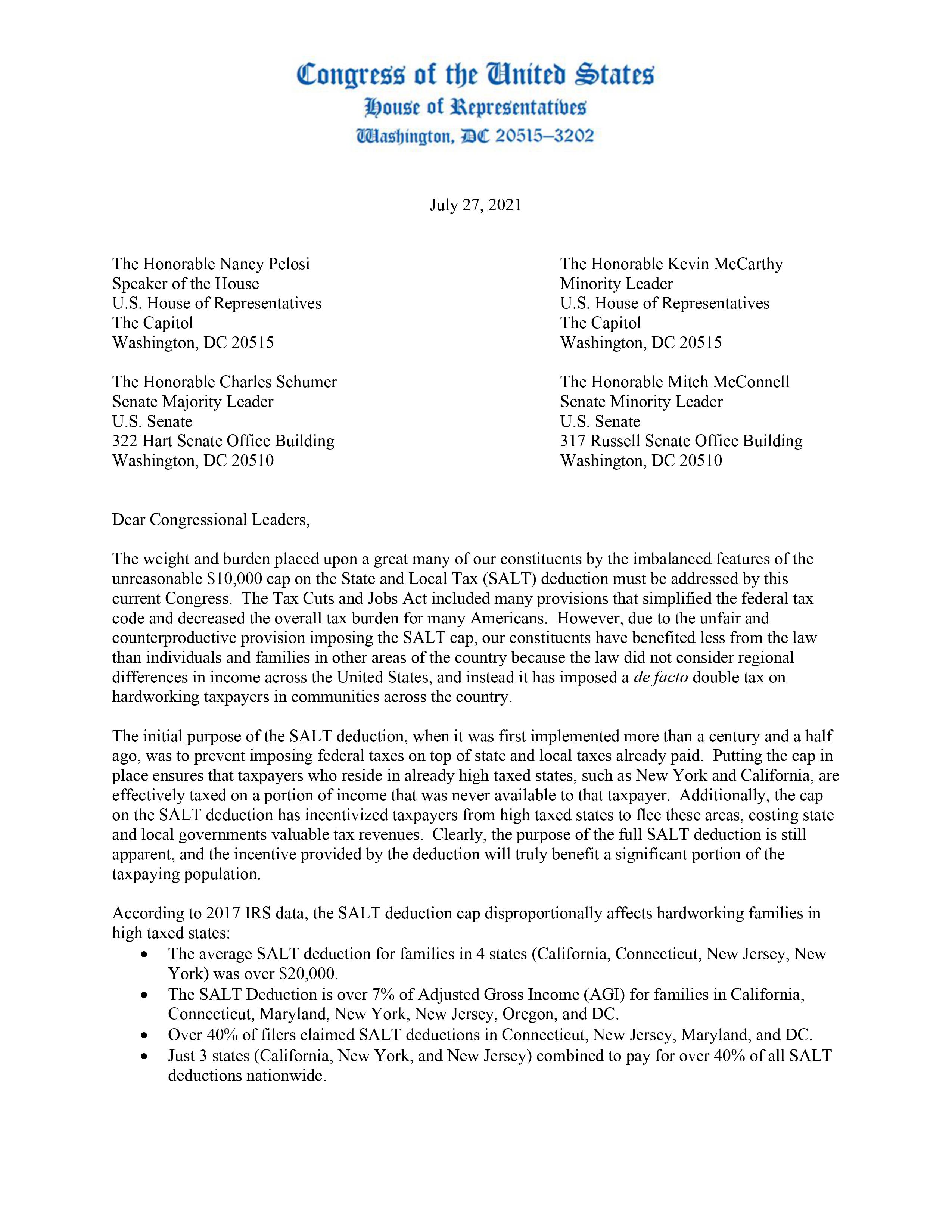

. Nationally SALT repeal would benefit 91 of all families. As negotiations continue on a bipartisan infrastructure agreement certain members of Congress from high-tax states are desperate to tack on a repeal of the 10000 cap on the. For tax years beginning on or after Jan.

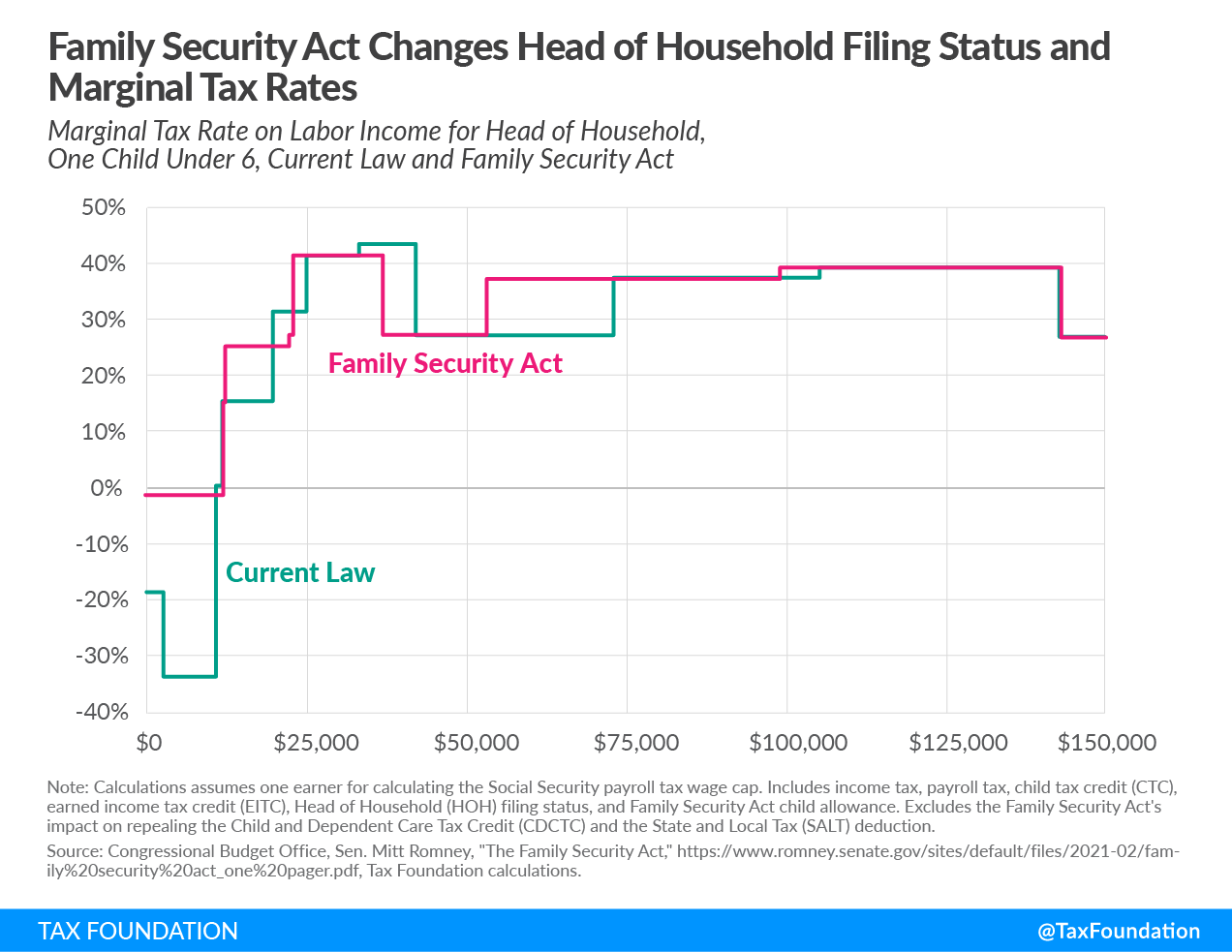

Trade-offs of Expanding Individual Tax Credits While Repealing SALT Deduction June 24 2021 Relaxing State and Local Tax Deduction Cap Would Make Tax Code Less. June 28 2021 by stellar icre in industry news cnbcs robert frank takes a look at calls from sen. The maximum SALT deduction is 10000 but there was no cap before 2018.

White Californians would save a total of 194 billion or almost 60 of the. As President Bidens tax plans are considered in Congress the future of the 10000 cap for state and local tax deductions SALT is becoming an important part of the tax debate. Heres what a partial repeal of SALT could look like for taxpayers June 28 2021 by Stellar ICRE in Industry News CNBCs Robert Frank takes a look at calls from Sen.

Salt Tax Cap Repeal 2021. One draft proposal floats 120 billion to lift the cap on state tax deductions for incomes up to about. Sanders a Vermont independent has proposed only allowing singles and married couples earning up to 400000 to write off all their SALT and phase out the tax break above.

For details on California and several other state laws see ongoing updates to my June 22 2021 blog post Unlock State Local Tax Deductions With A SALT Cap Workaround. The bill would have raised the cap to 20000 for joint returns for 2019 and eliminated it for 2020 and 2021 for taxpayers with incomes below 100 million. Illinois Assembly Approves SALT Workarounds for Partnerships Bloomberg Tax.

Salt Tax Cap Repeal 2021. Senate democrats have said they intend to leave the. The tax cuts and jobs act imposed a 10000 cap on the itemized deduction for state and local taxes from 2018 through 2025.

CLICK HERE TO READ MORE FROM THE WASHINGTON. The SALT deduction allows you to deduct your payments for property tax payments and either income or sales tax payments. The tax cuts and jobs act imposed a 10000 cap on the itemized deduction for state and local taxes from 2018 through 2025.

1 2021 nonpublicly traded partnerships with New Yorksource income can elect to be taxed at the partnership level NY. You must itemize using Schedule A to claim the SALT deduction. In California it would benefit 204.

Salt Tax Repeal News. 54 rows The Internal Revenue Service IRS has provided data on state and local. Most people do not qualify to itemize.

On June 11 2021 the Georgia Department of Revenue Department issued Notice SUT 2021-002 which proposes to. The Tax Cuts and. The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments.

During 2021 we predict that at least three states will enact legislation allowing for new sin taxes ie legalization of marijuana andor sports betting or adopting millionaire. The Tax Foundation predicts that a full repeal of the cap could reduce federal revenue by 380 billion through 2025.

Congress And The Salt Deduction The Cpa Journal

Why Some Lawmakers Are Pushing To Repeal Salt Caps

On Salt Dems Push Tax Relief For The Rich Not The Middle Class Editorial Nj Com

Sanders Signals Openness To Adjusting Salt Cap The New York Times

Ending The State And Local Taxes Salt Deduction

The Salt Cap Overview And Analysis Everycrsreport Com

Some Democrats Want To Repeal Salt Tax Deduction Cap But Others Say That S A Tax Cut For The Rich Cbs News

As Dems Push Salt Cap Repeal Many States Have Ok D Workaround Fox Business

Repealing Salt Cap Would Be Regressive And Proposed Offset Would Use Up Needed Progressive Revenues Center On Budget And Policy Priorities

Democrats Pressure Biden To Repeal Salt Deduction Cap

Salt Cap Opponents Pull In Union Support To Promote Repeal Bloomberg

Aft Throws Support Behind Effort To Repeal Salt American Federation Of Teachers New Jersey Afl Cio

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

Salt Cap Relief Faces Setback Talley Co

These States Offer A Workaround For The Salt Deduction Limit

Rep Andrew Garbarino On Twitter I Led A Letter To Congressional Leadership Calling For The Immediate Repeal Of The Salt Deduction Cap Now Is The Time For Congress To Act And Remove

How Dems Can Get Out Of The Salt Mess And Save 1 Trillion

Why A 10 000 Tax Deduction Could Hold Up Trillions In Stimulus Funds The New York Times

Richest 1 Of Americans Would Gain 62 Of Benefits With Salt Cap Repeal