how to calculate nh property tax

All documents have been saved in Portable Document Format unless otherwise. To calculate the annual tax bill on real estate when the property owner isnt eligible for any.

Residential Taxpayer Resources Nashua Nh

Then you multiply that amount by the number of rooms in the house.

. NH property tax rates are set in the Fall and are retroactive to April 1st of that same year. Property tax bills in New Hampshire are determined using factors. For comparison the median home value in New Hampshire is.

Ad Get In-Depth Property Tax Data In Minutes. You Report Revenue We Do The Rest. Ad Easily File Your Rental Property Taxes.

The median property tax in New Hampshire is 463600 per year for a home worth the median value of 24970000. Such As Deeds Liens Property Tax More. If you make 70000 a year.

The RETT is a tax on the sale granting and transfer of real property or an interest in real property. The State of NH imposes a transfer fee on both the buyer and the seller of real estate at the rate of 750 per 1000 of the total price. The property tax rate in.

How to Calculate Your NH Property Tax Bill. Tax amount varies by county. The local tax rate where the property is.

Municipal reports prior to 2009 are available by request by calling the department at 603 230-5090. New Hampshire Income Tax Calculator 2021. Your average tax rate is 1198 and your.

The result is the tax bill for the year. For example if your assessed value is 100000 and your tax rate is 10000 you will pay 10000 in property. The assessed value of the property.

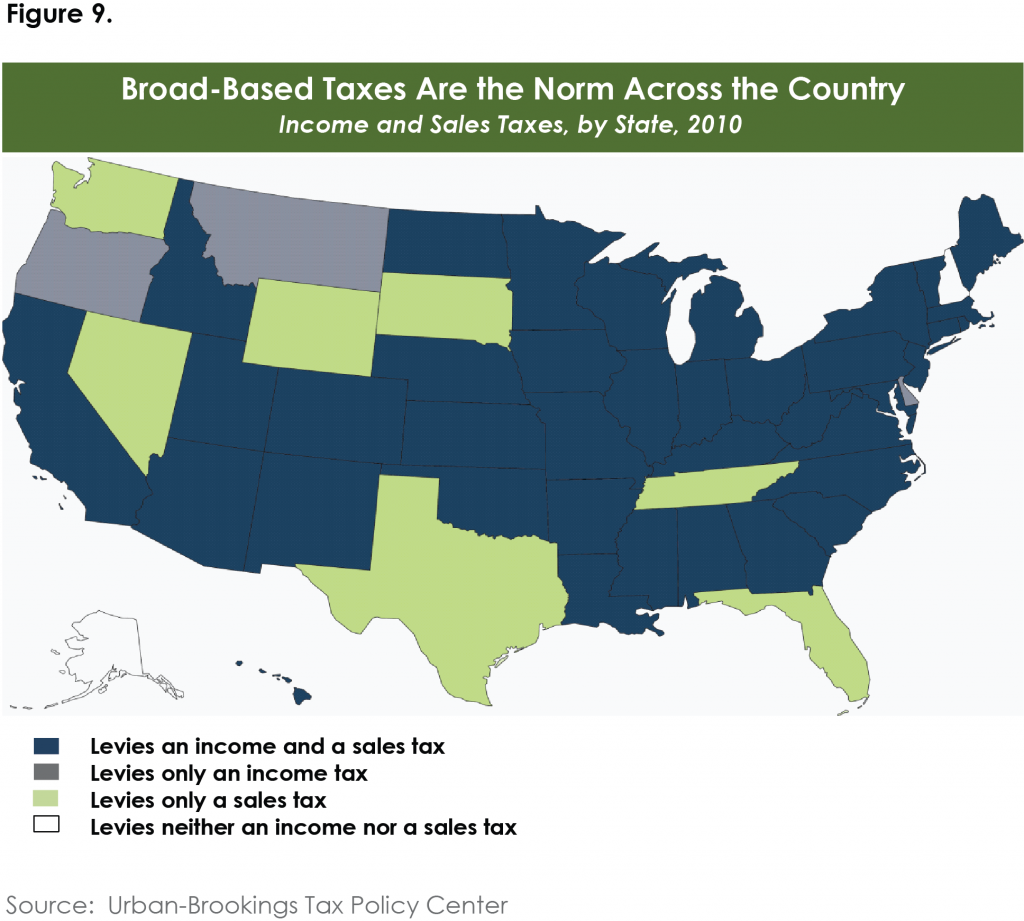

Search Valuable Data On A Property. 186 of home value. New Hampshire levies special taxes on electricity use 000055 per kilowatt hour communications services 7 hotel rooms 9 and restaurant meals 9.

The result is the tax bill for the year. The formula to calculate New Hampshire Property Taxes is Assessed Value x. If you make 70000 a year living in the region of New Hampshire USA you will be taxed 11767.

Hebron has the lowest property tax rate in New Hampshire with a tax rate of 652 while Claremont has the highest property tax rate in New Hampshire with a tax rate of 4098. For transactions of 4000 or less the minimum tax of. New Hampshires tax year runs from April 1 through March 31.

With taxes to be raised of 10000 and a town-wide assessed value of 500000 the tax rate would remain 20 per 1000 of valuation and each property would again owe 5000 in. Start Your Homeowner Search Today. The formula to calculate New Hampshire Property Taxes is Assessed Value x Property Tax Rate1000 New Hampshire Property Tax.

The statute imposing the tax is found at RSA 78-B and NH Code of Administrative Rules Rev. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Once you know the propertys value you simply multiply that by the tax rate.

To calculate the annual tax bill on real estate when the property owner isnt eligible for any exemptions multiply the assessed value by the total tax rate and divide the result by.

New Hampshire Tax Rates Rankings Nh State Taxes Tax Foundation

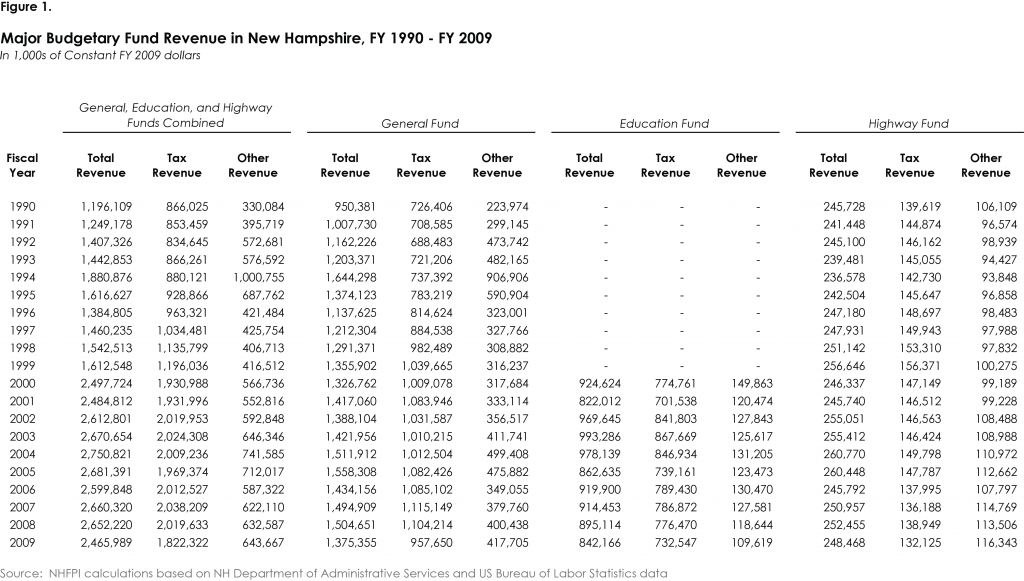

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute

Property Tax How To Calculate Local Considerations

Online Property Tax Calculator City Of Portsmouth

The Ultimate Guide To New Hampshire Real Estate Taxes

Timber Basis Decision Model A Calculator To Aid In Federal Timber Tax Related Decisions Extension

Which Nh Towns Have Highest Property Taxes Citizens Count

How Is New Hampshire S Real Estate Tax Calculated

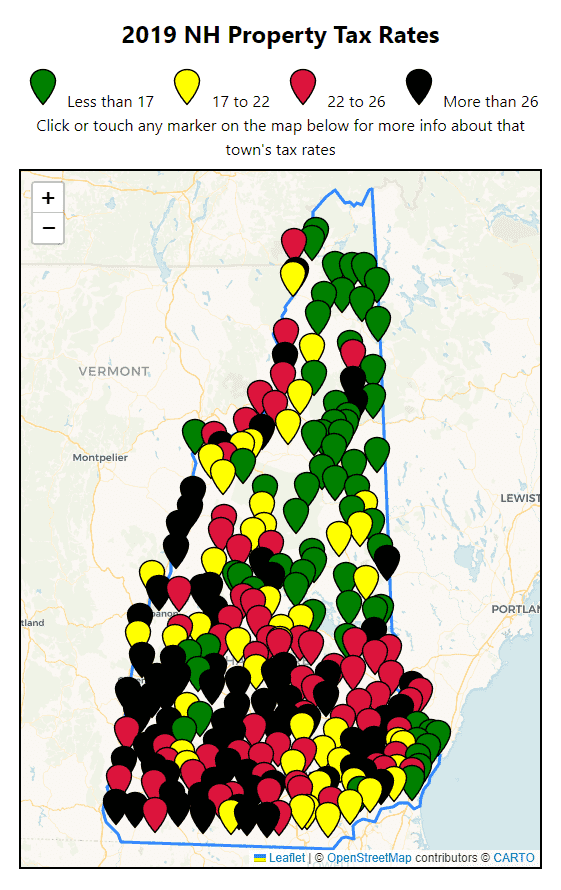

New Hampshire 2019 Property Tax Rates Nh Town Property Taxes

2021 Tax Rate Set Hopkinton Nh

Property Tax Calculator Smartasset

Property Tax Calculator Smartasset

Understanding Property Taxes In New Hampshire Free State Project

Newmarket Tax Rate Set At 25 46

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute

Statewide Education Property Tax Change Provides Less Targeted Relief New Hampshire Fiscal Policy Institute

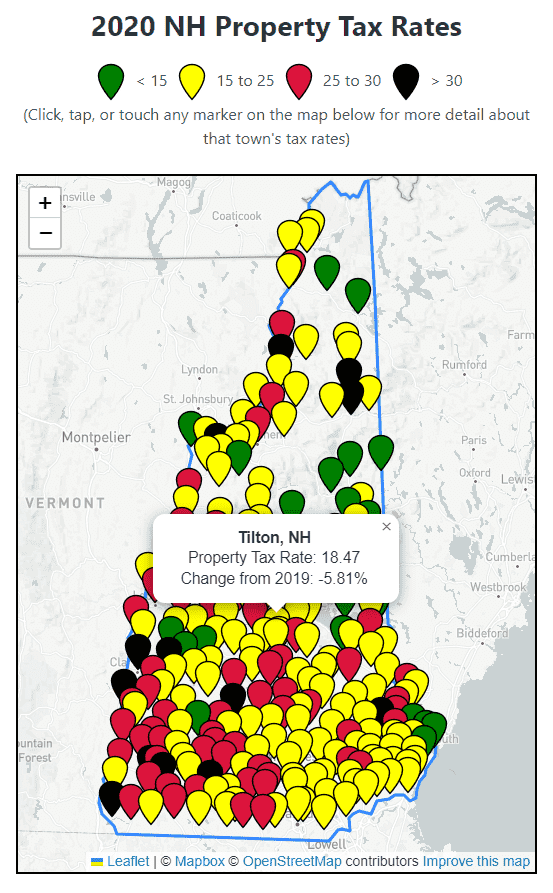

2020 New Hampshire Property Tax Rates Nh Town Property Taxes